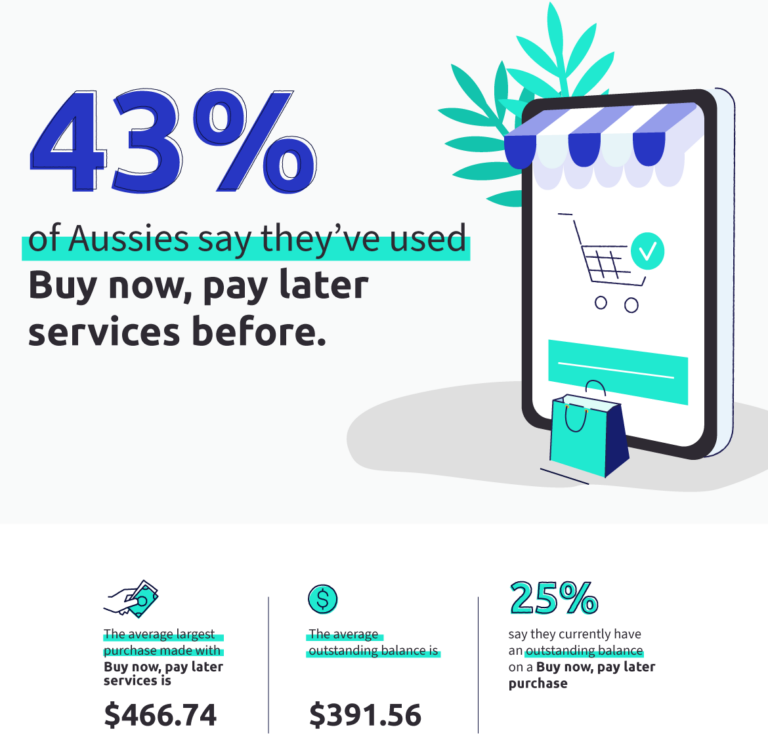

Optus Mobile Review ALDI Mobile Review Amaysim Mobile Review Belong Mobile Review Circles.Life Review Vodafone Mobile Review Woolworths Mobile Review Felix Mobile Review Best iPhone Plans Best Family Mobile Plans Best Budget Smartphones Best Prepaid Plans Best SIM-Only Plans Best Plans For Kids And Teens Best Cheap Mobile Plans Telstra vs Optus Mobile Optus NBN Review Belong NBN Review Vodafone NBN Review Superloop NBN Review Aussie BB NBN Review iiNet NBN Review MyRepublic NBN Review TPG NBN Review Best NBN Satellite Plans Best NBN Alternatives Best NBN Providers Best Home Wireless Plans What is a Good NBN Speed? Test NBN Speed How to speed up your internet Optus vs Telstra Broadband ExpressVPN Review CyberGhost VPN Review NordVPN Review PureVPN Review Norton Secure VPN Review IPVanish VPN Review Windscribe VPN Review Hotspot Shield VPN Review Best cheap VPN services Best VPN for streaming Best VPNs for gaming What is a VPN? VPNs for ad-blocking BNPL services are on the up-and-up in Australia, and according to our survey 43% of Aussies say they’ve used a BNPL service before. On the surface, they offer convenience; instead of paying for your purchase outright, you can opt to go onto a payment plan to pay off your products over several weeks. And with Christmas shopping looming ahead, it’s easy to see the appeal of delaying large payments in favour of smaller, manageable chunks. Especially if you’ve got your eye on a shiny new flagship phone, like the iPhone 13 or Samsung Galaxy S21, or even a new laptop.

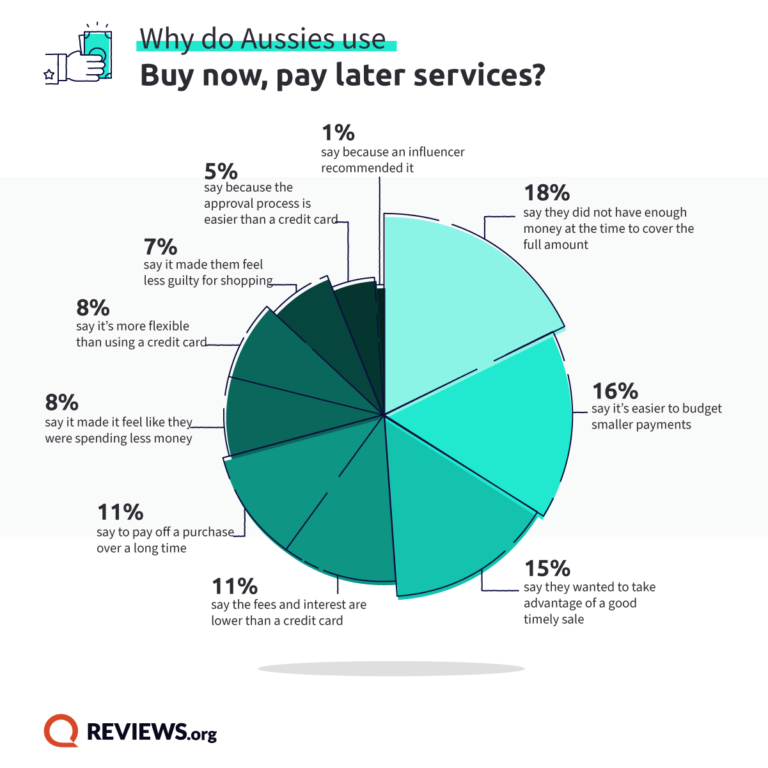

18% say they did not have enough money at the time to cover the full amount 16% say it’s easier to budget smaller payments 15% say they wanted to take advantage of a good timely sale

Many compared BNPL services to using a credit card.

11% say the fees and interest are lower than a credit card 8% say it’s more flexible than using a credit card 5% say because the approval process is easier than a credit card

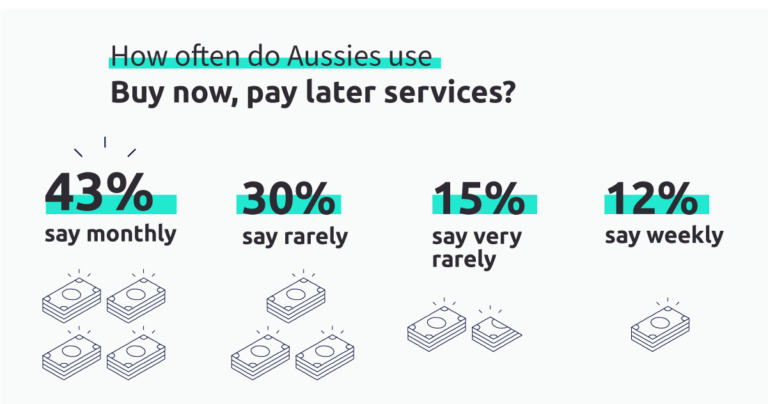

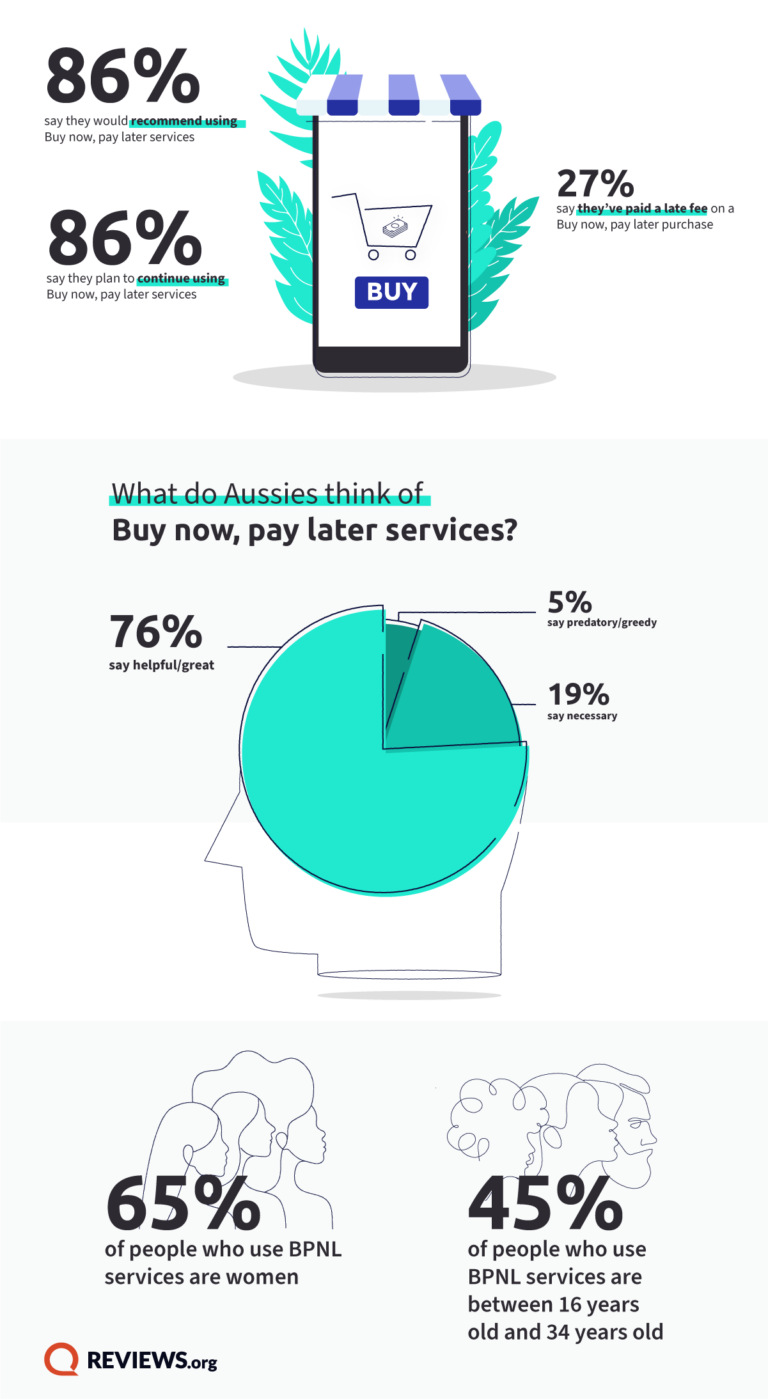

However, we found that users look at BNPL providers favourably, with 86% surveyed saying they plan to continue using BNPL services, and 86% saying they would recommend using them. Only 5% thought that BNPL services were predatory or greedy. For many Aussies, using a BNPL service is a regular habit, with 43% of survey respondents saying they use BNPL services monthly. 12% said they use them weekly, while 30% said they use them just once or twice a year.

Watch your spending: it’s easy to overspend on things you can’t afford when you’re not paying for them upfront. Loan applications can be affected: just like any debt, lenders consider BNPL spending when you apply for a loan like a mortgage. Fees can add up: even if they don’t charge interest, double check the fees involved so you can stay on top of them It can be unmanageable: with so many BNPL services, if you sign up to several, it can be much harder to keep track of your payments, which could result in late payment fees.

All figures are in $AUD.